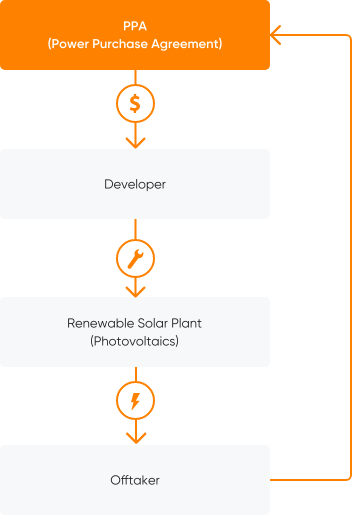

The key tool to a successful transition to a low carbon environment.

Power Purchase

Agreements - PPAs

PPA benefits

Reduces LCOE

The increased stability introduced by the PPA reduces the return requirements, and in turn pushes down the levelized cost of energy (LCOE).

Disruptive & Competitive

A PPA makes it possible for offtakers to buy renewable electricity at a price which, in more and more markets, can be realised below spot market prices in return for a long-term commitment.

Best of all: subsidy-free!

Up until today investments in renewable energy projects have been heavily dependent on subsidies. Governments have lately cut back on subsidies due to high costs for consumers. This has dramatically lowered the number of new projects.

Our PPAs are self-supporting by design and do not rely on any aid from local governments. The cost for the taxpayers is zero.

Why are PPAs important?

A Power Purchase Agreement (PPA) brings long-term predictability in a world of uncertainties to the Developer and the Offtaker.

By extension this turns renewable energy projects into a great investment opportunity for the Investor. PPAs was the missing puzzle piece for a sustainable future.

Who is Our New Energy?

- Our New Energy is the most experienced PPA origination and advisory firm in the world, having closed +4.5GW of long term fixed price PPAs for unsubsidised projects.

- We understand both the financial and energy side of a deal which makes it possible for us to facilitate efficient dialogues and break dead-locks.

- Our team of experts can advise you throughout the process and defend your interests best.

- Together we create win-win PPAs that benefit you, other stakeholders and last but not least - the planet.

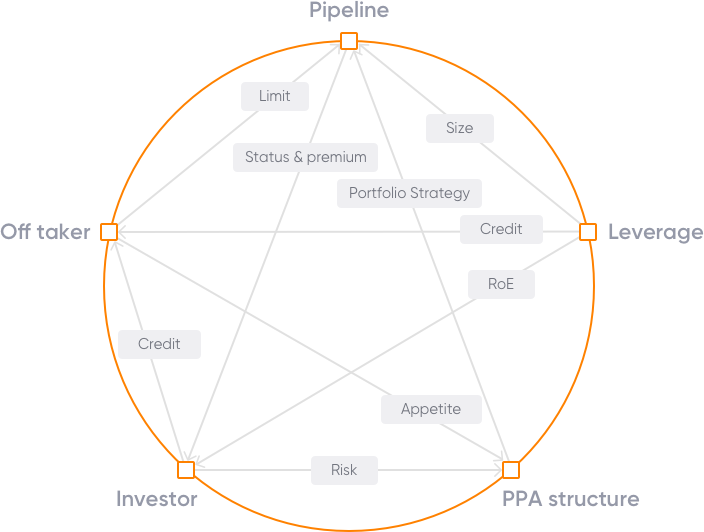

Our services along the PPA process

We have developed a work flow that has resulted in many successful PPA transactions. And speaking from experience we know that all Power Purchase Agreements are different in one way or another and that each client has different specific requirements. Therefore the lead time in each phase are estimates and largely driven by the parties involved as well as market situation.

-

Structuring

This is the most crucial phase as it determines all further phases and also the likelihood of successfully closing a PPA. The aim of this stage is to find the optimal transaction structure for you based on your motivating factors, perspective and risk profile.

-

Origination

Once the optimal PPA has been identified we focus on finding interested offtakers based on the optimal structure criterias.

Our team will approach each of these offtakers to secure preliminary offers and term-sheets. -

Negotiation

We narrow the list of off-takers to proceed with negotiations. Our main task is to ensure focus on the key value adding points, and ensuring that local market nuances are being properly addressed.

This phase concludes with the signing the PPA. -

Closing

Depending on the structure of the deal there can be little to no work in this phase. Sometimes though financing partners or co-investors are introduced in this phase where we help them properly assess the PPA and embed it into the overall investment transaction for you.

Recent projects

MYTILINEOS S.A.

- Technology

- Solar

- Type

- Undisclosed

- Size

- 63 MW

BELANUS PARTNERS

- Technology

- Solar

- Type

- Undisclosed

- Size

- 6.7 MW

Svea Solar

- Technology

- Solar

- Type

- 10 year fixed-price PPA

- Size

- Undisclosed